Fibonacci Retracements Analysis 14.04.2021 (GBPUSD, EURJPY)

GBPUSD, “Great Britain Pound vs US Dollar”

In the H4 chart, after re-testing 38.2% fibo at 1.3643, GBPUSD has rebounded from this level. This rebound together with a convergence on MACD may be a signal in favor of a new rising wave to reach the high and the long-term fractal high at 1.4241 and 1.4376 respectively. Another scenario implies that the price may reach its previous local high and start forming a sideways channel, which may be considered as an intermediate phase within the descending correction towards 38.2% and 50.0% fibo at 1.3643 and 1.3457 respectively.

The H1 chart shows a new growth after a local convergence on MACD and a test of the low. The pair is approaching 23.6% fibo but the key upside targets are 50.0% and 61.8% fibo at 1.3955 and 1.4022 respectively. A breakout of the local low at 1.3669 may lead to a further mid-term downtrend.

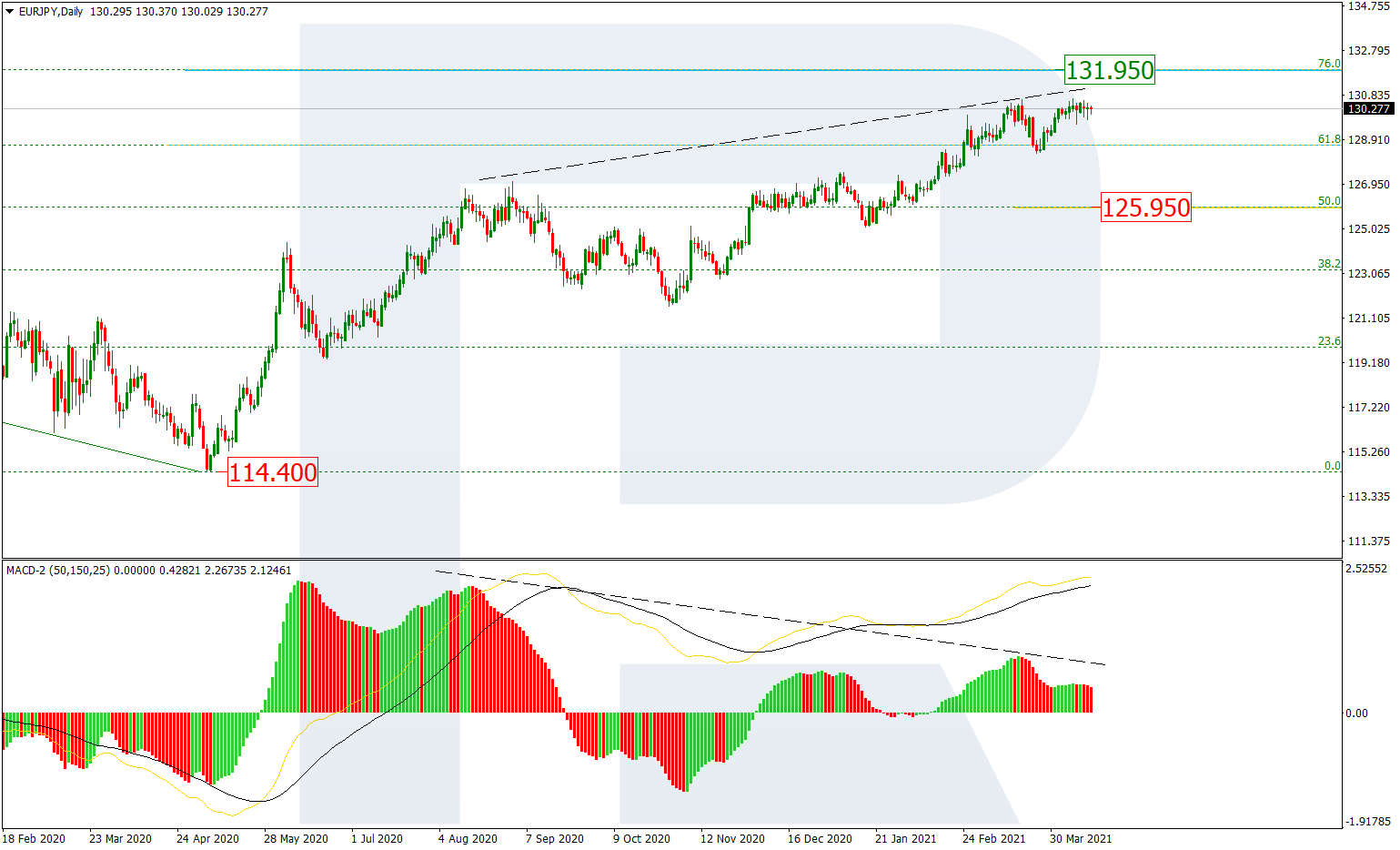

EURJPY, “Euro vs. Japanese Yen”

The daily chart shows that the rising wave is approaching 76.0% fibo at 131.95. Taking into account a divergence on MACD, EURJPY may reverse and resume falling towards the local support at 50.0% fibo (125.95).

As we can see in the H4 chart, after completing the correctional downtrend at 23.6% fibo, the asset is attacking the high at 130.66 once again, a breakout of which may lead to a further uptrend towards the post-correctional extension area between 138.2% and 161.8% fibo at 131.57 and 132.13 respectively with the mid-term 76.0% fibo inside it. The support is the local low at 128.29.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.